GOLD sharply higher on Fri,21Nov'08, able to break $768 and as soon as broken convincingly reached next area very fast and settled $791.80 after showing a high of $802.8, whereas spot gold closes $801.60, some hours later pit closes.

GOLD sharply higher on Fri,21Nov'08, able to break $768 and as soon as broken convincingly reached next area very fast and settled $791.80 after showing a high of $802.8, whereas spot gold closes $801.60, some hours later pit closes. Some reports like World Gold Council showed Q3 of 2008 consumer demand was 249.5 tonnes, which is 31% higher than Q3 of 2007.

Some short covering, switch over of option expires and some opportunity of buying in the weekend before Thursday 27Nov'08, thanksgiving day holiday in US, taken prices higher.

At the same time, there was a criticism by former president of Iran on Friday on the comments of chief of IAEA.

Other counters like Dow Jones, Silver, Crude oil or Copper doesn't support Gold move higher as such on this Friday apart from some short covering or profit booking in the wekend.

DOW JONES broken last weeks low, on Friday made a new low of 7449.38 and after covering some shorts, closed at 8046.46 parallel to other major indices of world. Breaking of resistance 8495-580 can create some volatility and upward movement.

SILVER was within last weeks range and apart from sympathy buying with gold lately, didn't do much and able to kept it within a rectangle formation on weekly chart. Breaking of nearby resistance 986-88c can create some volatility and upward movement.

CRUDE OIL could be able to push higher with the event of biggest hijacking ever and farthest from Somalian shore of a Saudi Arabian supertanker carrying $100 million of crude. However, market discounted this event and made a new low of $48.25 for Jan'09 contract. Natural gas fallen below $2 after march'05when Dow Jones was 10805.63.

COPPER is also alike Dow and silver made a new low in this week, touched July'05 lows and didn't make any sign of turn back, only some little short covering at weekend.

I personally not very much optimistic about gold here at this price area even as an investment tools. Any sign yet to get about world economy to be corrected from here rather situation probably different. After US and EU, Japan has also entered into recession. China is in deep trouble with job cuts and slowing economy and before election, condition of India is not very clear but economy is slowing and unemployment is rising. People fear about recession and deeper recession but not deflation or hyper inflation, hopefully which global economy can avoid. So possible gold is going to leave this gain very soon if no blunder situation does occur.

Some comparison charts here below, within these, mainly silver is not supporting higher gold which can become alarming for gold, bcause it seems to have offload many longs:

SILVER was within last weeks range and apart from sympathy buying with gold lately, didn't do much and able to kept it within a rectangle formation on weekly chart. Breaking of nearby resistance 986-88c can create some volatility and upward movement.

CRUDE OIL could be able to push higher with the event of biggest hijacking ever and farthest from Somalian shore of a Saudi Arabian supertanker carrying $100 million of crude. However, market discounted this event and made a new low of $48.25 for Jan'09 contract. Natural gas fallen below $2 after march'05when Dow Jones was 10805.63.

COPPER is also alike Dow and silver made a new low in this week, touched July'05 lows and didn't make any sign of turn back, only some little short covering at weekend.

I personally not very much optimistic about gold here at this price area even as an investment tools. Any sign yet to get about world economy to be corrected from here rather situation probably different. After US and EU, Japan has also entered into recession. China is in deep trouble with job cuts and slowing economy and before election, condition of India is not very clear but economy is slowing and unemployment is rising. People fear about recession and deeper recession but not deflation or hyper inflation, hopefully which global economy can avoid. So possible gold is going to leave this gain very soon if no blunder situation does occur.

Some comparison charts here below, within these, mainly silver is not supporting higher gold which can become alarming for gold, bcause it seems to have offload many longs:

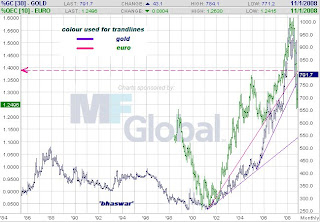

At the end, I'm adding one box of charts, from which we can get eassily the price of GOLD in different currency:

____________________________________________________

___________________________________________